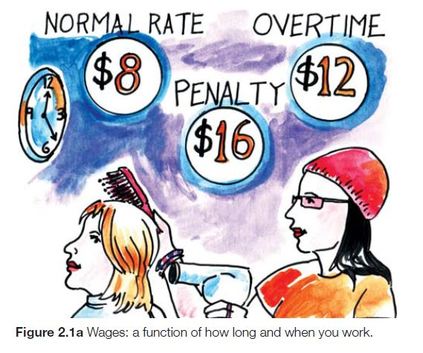

1.0 EARNING AN INCOME

Chapter 1: Spending and Saving

|

You will need:

Key Terms:

Tasks:

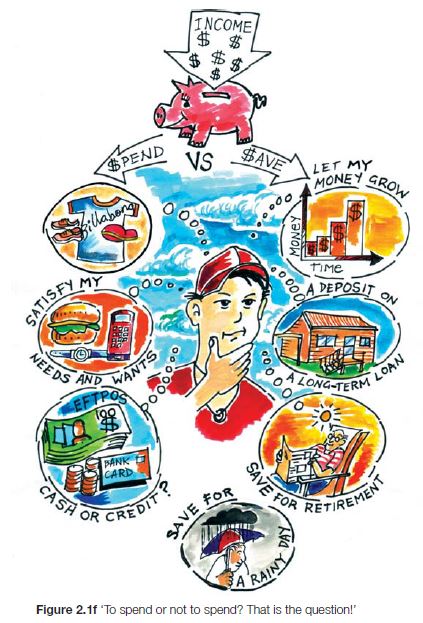

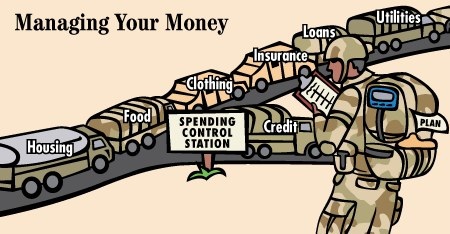

HOMEWORK ACTIVITY Imagine your income is $300 per week. Think about how you would divide this amount amongst the 7 spending and saving options in the diagram (LEFT). In a small paragraph decide on how much yo would allocate and discuss your decisions. |

Chapter 2: Managing Your Money

|

You will need:

Key Terms:

Tasks:

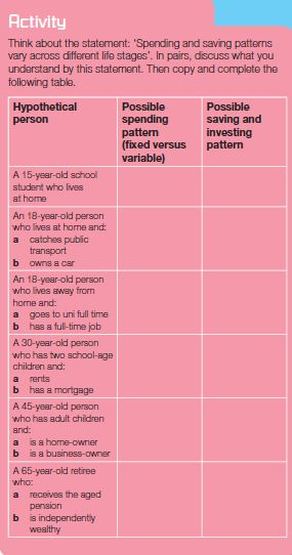

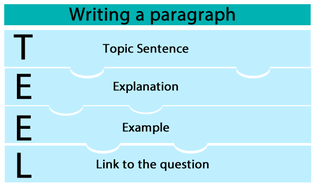

WRITING ACTIVITY Choose ONE of the following statements and write a structured paragraph in response to it.

|

RATES OF SAVING WORKSHEET

| ||||||